How much house loan should i take

Ad Learn More About Mortgage Preapproval. The maximum loan you can avail depends on the maximum EMI you can pay from yourmonthly disposable income which is fixed as a percentage by the.

5 Ways To Calculate How Much House You Can Afford Refinance Mortgage Refinancing Mortgage Mortgage Interest Rates

So for the affordable Rs 40000 EMI the loan amount you would get is Rs 50 lakh.

. Ad More Veterans Than Ever are Buying with 0 Down. Saving for a home isnt one-size-fits-all. A more conservative rule of thumb is to limit your monthly mortgage payment to 25 of your after-tax income ie what you see in your bank account.

This includes your principal interest real estate taxes hazard insurance association dues or fees and principal mortgage insurance PMI. Your minimum take home salary should be 25000 per month to be eligible for Bajaj Finserv home loan. 2 to 5 for closing costs.

A home equity loan is a loan in which borrowers use their house as collateral. But as banks only lend about 80 per cent of the cost its clear that you need to put in Rs 125. Nevertheless depending on a case-to-case basis an applicants repayment capacity should be.

Were Americas 1 Online Lender. To calculate u2018how much house can I affordu2019 a good rule of thumb is using the 2836 rule which states that you shouldnu2019t spend more than 28 of your. 25 to celebrate President Biden cancelling student.

This mortgage calculator will show how much you can afford. The home loan amount on your salary. Were Americas 1 Online Lender.

Last week President Biden laid out a sweeping plan to cancel up to 20000 in federal student loan debt per borrower. In a long-term loan the interest outgo is too high. The 2836 Rule is a commonly accepted guideline used in the US.

As a thumb rule the price of the house that you are looking to buy on a home loan should not be more than 5 times of your annual income. Get Started Now With Quicken Loans. Apply for Your Mortgage Now.

You would divide 1200 by. This calculator computes how much you might qualify for but does not actually qualify you for a. The first step in buying a house is determining your budget.

Looking For A Mortgage. Looking For A Mortgage. Your gross monthly income is 4200.

To get that maximum individuals must. Our Experts Are Committed To Helping Customers Find Their Best Home Loan Solution. 2 days agoLA JohnsonNPR.

Examining 3 of the arguments of a heated debate. Browse Information at NerdWallet. Compare Rates of Interest Down Payment Needed in Seconds.

However it is best to take a loan for the shortest tenure you can afford. Insurance and other costs. Get Started Now With Quicken Loans.

With that magic number in mind you can. Student loan borrowers stage a rally in front of The White House on Aug. Ad Our Reviews Trusted by 45000000 Compare Home Equity Loan Rates.

Ad Realize Your Dream of Having Your Own Home. Take Advantage And Lock In A Great Rate. And Canada to determine each households risk for conventional loans.

Mar 20 2018 Home equity is great for homeowners looking to take out a low interest loan. By using the 28 percent rule your mortgage payments should add up to no more than 19600 for the year which equals a monthly payment of 1633. Its A Match Made In Heaven.

A homeowner or tenant earning 50000 each year should spend up to 1250 to 1667 monthly for housing costs to keep home affordability under check. What should be the price of a house. In a 10-year loan the interest paid is 57 of the.

View Ratings of the Best Mortgage Lenders. Interest rates shown are for. If your credit score is between 500-579 you may still qualify for an FHA loan with a 10 down payment.

Its A Match Made In Heaven. 3 for a down payment. Find out how much house you.

Gross monthly income income before taxes For example say your total housing costs for a month is 1200. Keep in mind that generally the lower your credit score the higher your interest rate. Ad Compare Mortgage Options Get Quotes.

It states that a household should spend no more than. Fill in the entry fields and click on the View Report button to see a. 25 Post-Tax Model.

Ad Compare Mortgage Options Get Quotes. Ad Whether Youre Buying Or Building A Home Well Help Guide You Through The Entire Process. 300 to 500 for inspection.

How much home loan can I get for my salary. Lender Mortgage Rates Have Been At Historic Lows. But at a minimum youll likely need to set aside.

Pin On Dream Big Home Remodel

Mortgage Calculator Arrest Your Debt Mortgage Calculator Free Mortgage Calculator Mortgage

Handy Home Blog Calculating How Much You Can Afford To Spend On A Mortgage Payment Buying First Home Home Buying Tips Buying Your First Home

3 Mortgage Automation Tricks That Will Take Years Off Your Home Loan Mba Sahm Home Loans Mortgage Home Mortgage

Pin On Fairway Mortgage Colorado

How Much House Can I Afford Buying First Home Home Mortgage Mortgage Marketing

How Much Home Loan Can You Take Home Refinance Home Loans Loan

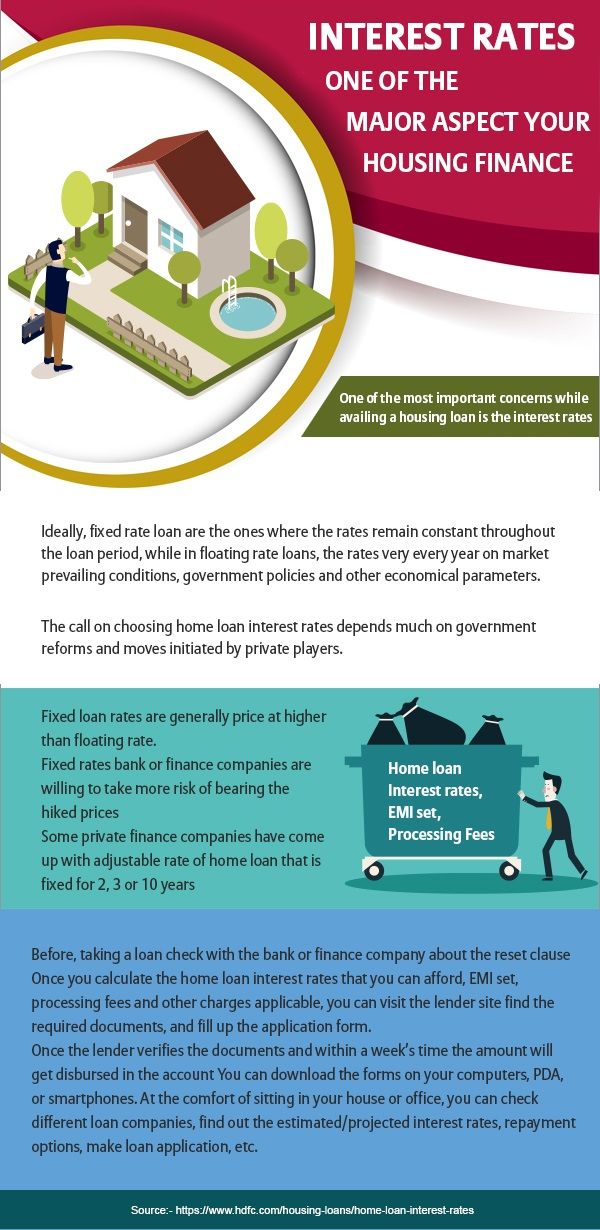

House Loan Interest Rates Create A Space Of Your Own With Hdfc Home Loans Best Housing Loan Interest Rates For Loan Interest Rates Home Loans Interest Rates

How Much House Can You Afford Home Loans Mortgage Loans Jumbo Mortgage

Check Out The New Maximum Fha Loan Amount If You Are Interested In Seeing What Loan Type Is Best Fo Mortgage Lenders Mortgage Loan Originator Home Mortgage

How Much House Can I Afford Insider Tips And Home Affordability Calculator Home Buying Process Buying First Home Home Buying Tips

How Much House Can I Afford Real Estate Advice Real Estate Education Real Estate Tips

Before You Start Shopping For A New Home Determine How Much You Can Afford To Spend By Considering Your Credit Score Monthly Inc Home Loans Home Buying House

How Much House Can You Afford Home Loans Loan Company Mortgage Companies

Physician Mortgage How Much Home Can I Afford Preapproved Mortgage Mortgage Corporate Brochure Cover

House Improvement Loan As The Name Suggests Are Provided To Individuals For The Purpose Of Improving Or Making The Home Home Loans Home Improvement Loans Loan

Know The Difference Between A Home Loan And Plot Loan Home Loans Plots Loan